Service providers continue to hold a vital position in providing infrastructure, networks, and interconnectivity to organizations and that drive their value proposition. The role of managed service providers and consultants has expanded, as they aid organizations in their cloud migration and offer strategic insights. Amidst the rapid changes, service providers remain agile, leveraging cutting-edge technologies and collaborating with partners to deliver exceptional services.

The COVID-19 pandemic accelerated these transformative trends, propelling the digital revolution forward. Cloud infrastructure will remain the prevailing deployment model, with third-party service providers playing a pivotal role in supporting and enriching its offerings. For any vendor seeking to connect with end users, navigating this complex ecosystem will be crucial, opening exciting possibilities for innovation and growth.

Ripple effects of hyperscale public clouds on the market

- Reselling and management: Service providers are reselling, managing, and adding value on top of hyperscale public clouds. They assist end users in cloud adoption and offer infrastructure management services, driving value beyond the infrastructure layer.

- Shuttering XSP-operated clouds: Hyperscale public clouds have replaced most multi-tenant public clouds operated by infrastructure service providers. Providers are exiting traditional services to focus on the public cloud value chain due to economies of scale and increased innovation.

- Colocation shift: As compute and storage move to the public cloud, colocation providers are shifting their focus to hyperscale colocation. They bypass end users and directly house public clouds, offering convenient and performant connectivity.

- Asset-light model: With the shift to reselling and managing public cloud, providers require fewer physical resources and data center capacity. This move towards an asset-light model shifts infrastructure requirements to an OpEx-based model, freeing up resources for innovation and service development.

- Increased specialization: As workloads migrate to the cloud, service providers are specializing in areas such as bare metal and private cloud. Value-add is being found in security, compliance, and industry-specific services like healthcare and financial services.

- Value of interconnection: Interconnection becomes more valuable as seamless connectivity to the cloud from various locations becomes crucial. Service providers that offer strong interconnection capabilities will have a competitive advantage.

- Blurring of MSPs and Managed Infrastructure Providers: The distinction between managed service providers (MSPs) and managed infrastructure providers is fading. With the rise of the public cloud, both types of providers are aligning their interests and offering similar services.

- Enabling the Edge: Service providers are addressing the challenge of decentralization by extending their infrastructure to the edge. New concepts and infrastructure are being tested to support the growing demand for edge computing.

The importance of selling to service providers

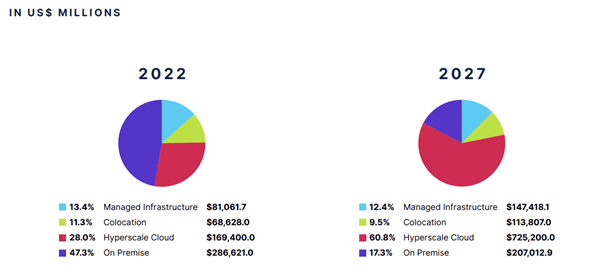

According to a study by Structure Research, the shift towards outsourced infrastructure services, including cloud and managed infrastructure, has changed the IT landscape and disrupted the traditional direct sales model. Organizations now rely on service providers to procure and manage infrastructure on their behalf, converting capital expenditure into operating expenses.

This transformation is important for technology vendors because it alters the addressable market. As more workloads are housed in outsourced environments, service providers become the primary purchasers of gear and software, reducing the direct procurement by end users.

Vendors must adapt and sell to service providers to maintain their market share and seize opportunities in this evolving ecosystem. Failing to do so limits their potential for growth.

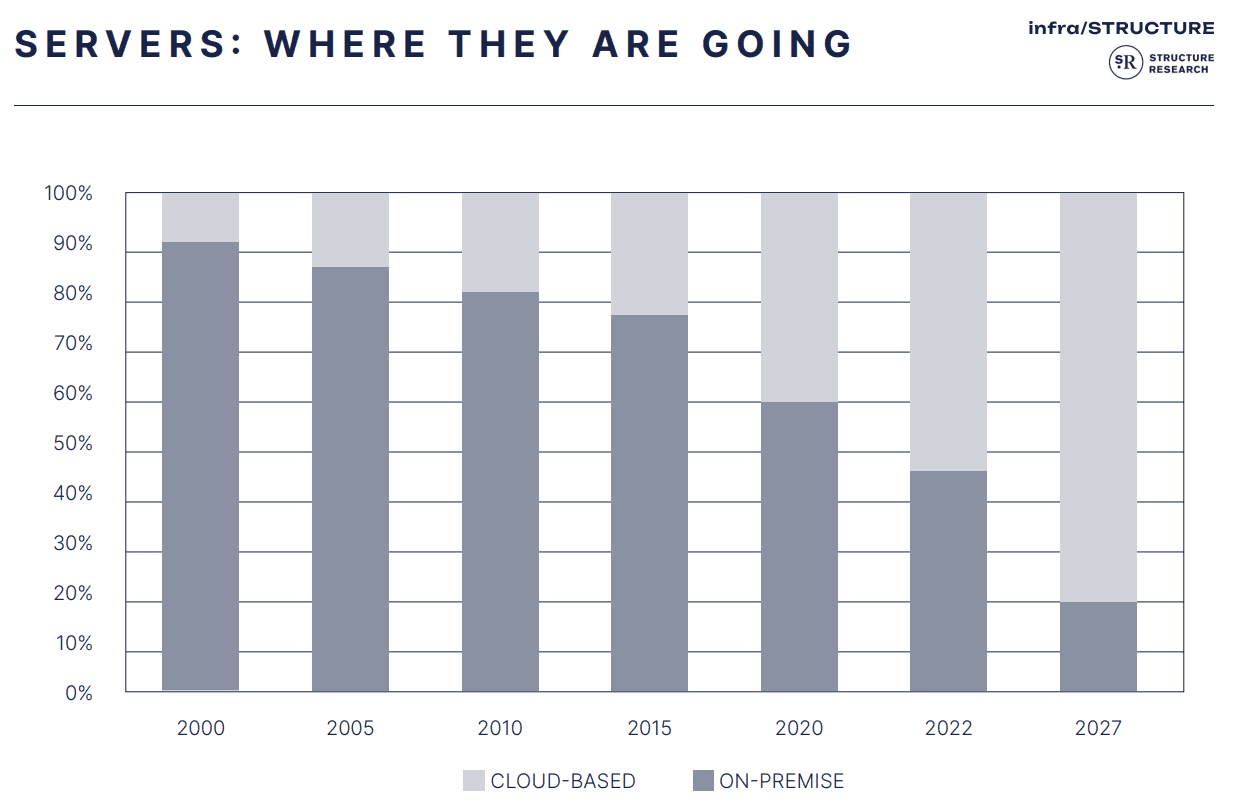

The recent data on server shipments and other indicators reveal a notable shift in the IT landscape, as a significant portion of servers are now being deployed in outsourced infrastructure environments. This trend underscores the growing presence of infrastructure service providers in managing and housing IT infrastructure. The surge in public cloud adoption and the continuous expansion of outsourced infrastructure services further emphasize this paradigm shift.

There is an increasing deployment of infrastructure in outsourced infrastructure environments, with this trend potentially accelerating. Concurrently, the on-premise installed base is anticipated to decline, with no foreseeable scenario for a rebound. This paradigm shift is poised to impact the global IT landscape.

Advantages of selling to service providers

- Service providers as an extensive channel to market:

- Service providers have a large customer base, offering immediate access to a substantial number of potential customers.

- Partnering with service providers allows vendors to productize their technology and reach a broad audience quickly.

- Lower subscriber acquisition costs through channel building:

- Acquiring individual customers can be costly, but working with service providers enables multiple customer acquisitions with scalable cost structures.

- Automation facilitates efficient upselling, resulting in improved margins and cost-effectiveness.

- Higher upside potential with service provider partners:

- Service providers offer significantly more growth potential compared to single enterprise customers.

- Service providers can expand aggressively, providing vendors with ample opportunities for growth.

- Service providers embrace copycat behavior:

- Service providers closely monitor and replicate successful technology adoptions by their competitors.

- Selling to service providers leads to built-in marketing as providers emulate each other’s IT infrastructure choices.

- Immediate scalability for young and startup vendors:

- Collaborating with service providers allows young technology vendors to rapidly gain traction and acquire multiple customers and use cases.

- Operational efficiency and reduced margin for error:

- Selling through service providers requires repeatable processes, promoting operational efficiency.

- Repeatability reduces the margin for error and enhances the overall user experience.

- Streamlined billing, support, and management:

- Service provider partnerships simplify billing processes and support, as vendors deal with a single point of contact for multiple customers.

- Managing relationships with service providers allows technology vendors to maintain a lean and efficient operational structure.

Challenges in selling to service providers

- Fragmented market: The service provider market is highly fragmented, making it difficult to consolidate and reach a wide range of providers.

- Finding service providers: Locating and connecting with service providers can be challenging due to the scattered nature of the infrastructure services business.

- Unclear decision-making: Decision-making processes among service providers, particularly smaller ones, can be dispersed and lack formal structures.

- Reluctance to disrupt operations: Service providers may hesitate to adopt new technologies if their existing systems are functioning adequately.

- Emphasis on open source: Many service providers rely heavily on open-source solutions to minimize costs.

- Limited adoption of third-party technology: Service providers traditionally focus on their own in-house solutions and may be hesitant to incorporate external technologies.

- Preference for in-house solutions: Service providers, often led by technology-oriented individuals, tend to prioritize building their own solutions over relying on external vendors.

Selling to service providers: Key strategies

- Revenue generation: Your technology should enable service providers to generate revenue by offering value-added products and services, driving operational efficiency, and lowering total cost of ownership.

- Productization: Transform your technology into a product or service that can be easily sold with a clear value proposition.

- Two-step selling process: Successfully partnering with service providers requires not only convincing them to deploy your technology but also supporting them in sales, marketing, and training to ensure success.

- Modular technologies: Offer flexible and customizable solutions that allow service providers to create tailored packages and upsell to meet diverse customer needs.

- Subscription-based billing: Adapt to various subscription-based billing models prevalent in the industry, such as monthly recurring, hourly, or per-second billing.

- API integration: Provide an API to facilitate seamless integration with service providers’ complex and customized back-end systems.

- Billing adaptation: Adjust billing methods to virtualized multi-tenant environments, considering the shift from per-server/device billing.

- Scalability: Allow service providers to start small with minimal upfront investment and scale as demand grows, leveraging Software-as-a-Service models.

- Identify decision-makers: Understand the procurement processes and identify the decision-makers within service provider organizations, whether it’s the CEO, CTO, or department heads.

- Co-marketing strategies: Collaborate with service providers on marketing initiatives to optimize resources, expand reach, and achieve mutual success.

- Avoid channel conflict: Minimize competition with service provider channel partners to maintain pricing consistency and facilitate co-marketing efforts.

- Understand target market: Align your offerings with the target market and product line of the service provider to ensure compatibility and relevance.

- Understand service provider: Demonstrate a deep understanding of service providers’ unique challenges, concerns, and language to establish credibility and effective communication.

- Problem-solving positioning: Position your technology as a solution that addresses service providers’ needs, whether it’s cost-saving, process improvement, or expertise enhancement.

By implementing these strategies, technology vendors can increase their chances of successfully selling to service providers and establishing fruitful partnerships.

Source credits: Structure Research

Read next: Acronis empowers MSPs to offer enhanced endpoint security with its new EDR solution