asgupta

Tue, 07/13/2021 – 12:18

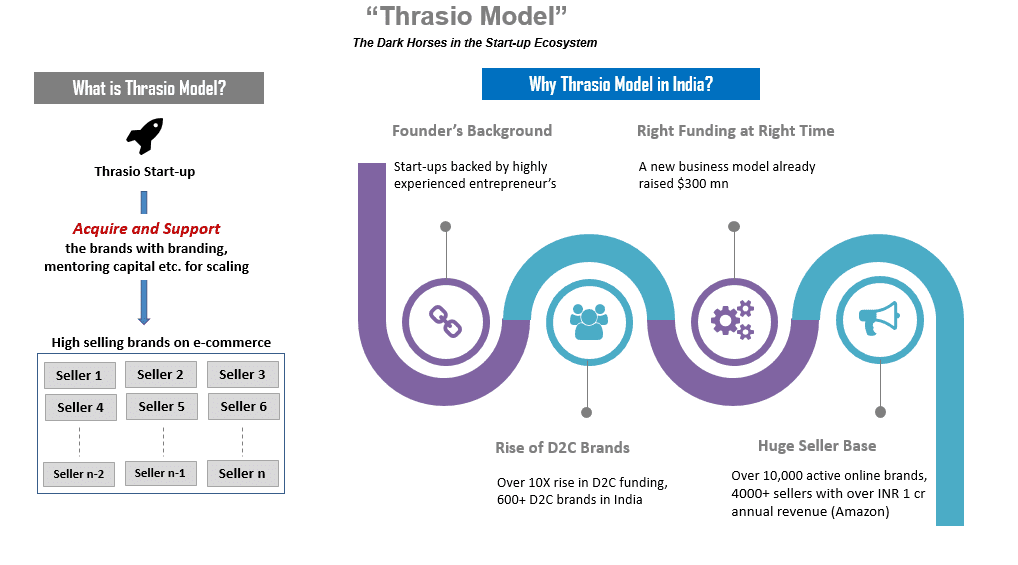

The Dark Horses of the Start-up Era: The Thrasio Model

You might be wondering about this newly invented word ”Tharasio” in the start-up ecosystem. Well, it’s not an invented word but the name of a 3-year-old US-based start-up that acquires private label Amazon FBA businesses and direct-to-consumer e-commerce brands. This Thrasio has now $500 mn in revenue and $100 mn in profit.

So, it was just a concept which turned out to be successful. So, why not apply it to India also. That’s what dozens of start-ups are doing and investors are also backing them up because of the potential this sector has to offer. Buying the hottest brands and giving them the required boost that’s what Thrasio is all about.

The concept being too new in India, it is difficult to comment on it’s success but the way it has been shaping, the outlook seems extremely favorable. Let’s start with the funding first:

Funding

Nearly $300 mn has been invested till now in over 10 start-ups. The highest ones are Global Bees, Mensa Brands, GOAT Brand Labs and 10 Club. These 4 start-ups alone raised over ~200mn. 10 Club raised $40 mn in the seed stage which is the highest ever seed stage funding in the history of the start-up ecosystem. So, funding wise this business model is doing good that too in a short span of time.

Founder’s Background

This parameter is playing a jackpot role for this business model. If you look at the profile of the founders of the start-ups in this space, you will find that they all have strong entrepreneurial skills or have managed a large business portfolio in their previous roles and that’s what investors are looking for.

Mensa Brands: Founded by Ex CEO Myntra, Co-founder and CEO Medlife

GOAT Brand Labs: Founded by Flipkart fashion head

Global Bees: Founded by First Cry Founder

10Club: Founder by former Lamudi CEO

Rise of D2C

The substantial growth of D2C brands in India is actually giving Thrasio model the push that it requires. D2C brands’ rising popularity and trust among people is giving prevailing brands a run for their money. 600+ D2C brands in India. 10X rise in D2C funding is past 2 years. ~1.6bn funding in D2C by 2020.

Huge Seller Base

India has over 10,000 online brands which are active on e-commerce platforms. As per Amazon India, it had over 4000+ sellers with over INR 1 cr annual revenue.

Frankly, above parameters are good enough to foresee the potential of this sector. Although, many market analysts have raised multiple questions on the sustainability and growth of this business model like:

- Value at which the Thrasio model start-up acquires a seller: Acquiring at higher valuation could stagnate the future growth

- High selling brand approached by multiple start-ups leading to more negotiations

- Thrasio is 100% online but what about offline business presence

Time will only tell how this business model will shape up in the near future but currently it is showing all possible signals for rapid growth.