Despite a pandemic, the mergers and acquisitions (M&A) market stormed ahead in 2021 with record-setting activity. As 2022 began headwinds started rising and dealmaking inevitably slowed from its previous year’s pace. Though it appears that there will be much more turbulence for M&A on the horizon this coming year, overall sentiment is still broadly positive despite these trying times.

Despite the tumultuous global economy, Asia Pacific (APAC) dealmakers have demonstrated remarkable resilience in their mergers and acquisitions activity. As 2022 ended on an optimistic note for APAC, these negotiators remain confident that the coming year will bring continued growth to this sector. According to a research by SS&C and Mergermarket, 86% of dealmakers in APAC believe M&A activity to increase in the next 12 months.

Key drivers of M&A in 2023

- 47% of APAC dealmakers say that the need to pursue digital transformation is one of the top factors that will drive M&A activity over the next 12 months. Many organizations are prioritizing secure access to new technologies in areas such as cloud computing, data analytics, artificial intelligence, and the Internet of Things.

- 52% of dealmakers cite increasing market share as a factor that is likely to drive deals for the year ahead.

- 41% of dealmakers indicate the need to capture synergies through M&A.

- 33% think that the chance to restructure and turn around struggling businesses is an important driver for M&A over the next year.

Key challenges to M&A activity in 2023

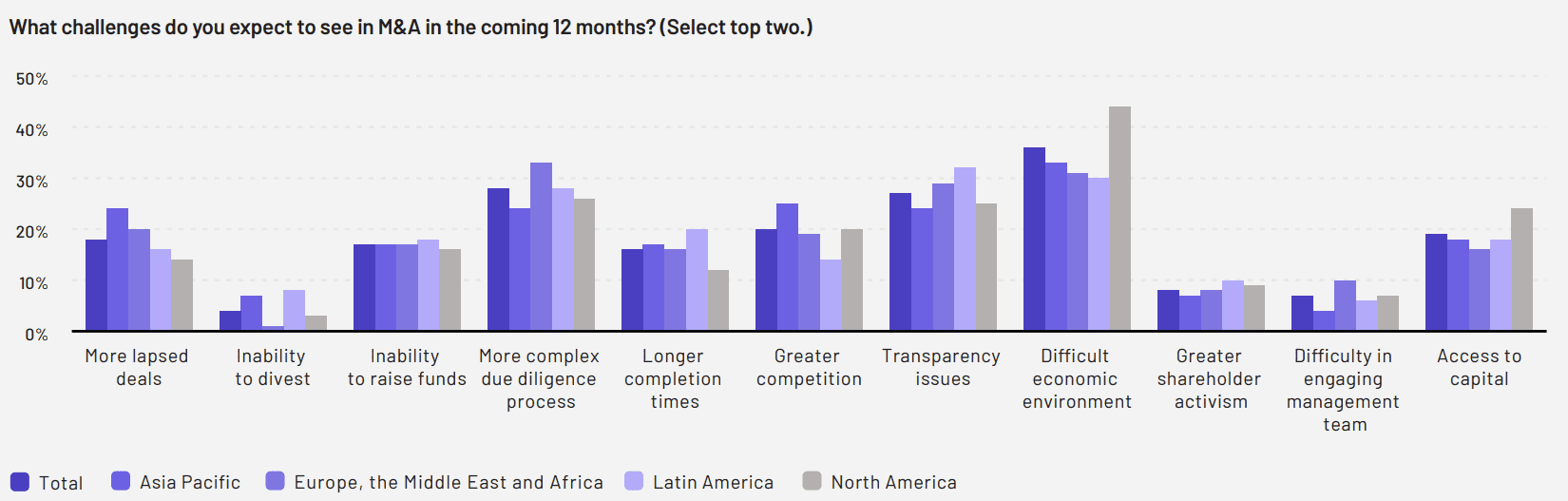

- 33% of APAC dealmakers cite the difficult economic environment ahead as the most pressing concern.

- 25% of APAC dealmakers are worried about the increasing competition for deals.

- 24% expect to see due diligence processes become more complex and worry about transparency issues.

- 24% of dealmakers are concerned about the possibility of transactions failing.

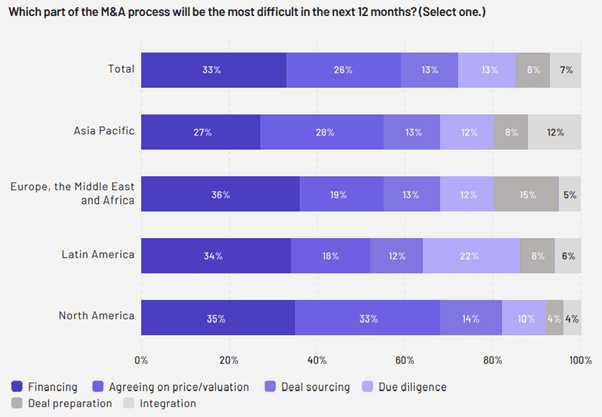

- 27% of dealmakers think that securing financing for transactions will be the most difficult element of M&A activity over the next 12 months.

- 28% are concerned about the difficulty of reaching an agreement on price.

Disruptive trends affecting M&A

20% of dealmakers in APAC believe that deal automation technologies can be a disruptive trend in M&A over the next 12 months. These tools can help speed up dealmaking processes and accommodate more complex due diligence requirements.

Cybersecurity is an ever-growing concern in M&A activity. In this region alone, 23% of dealmakers have expressed the importance they will place on cybersecurity technologies over the coming year.

Impact of ESG on M&A processes

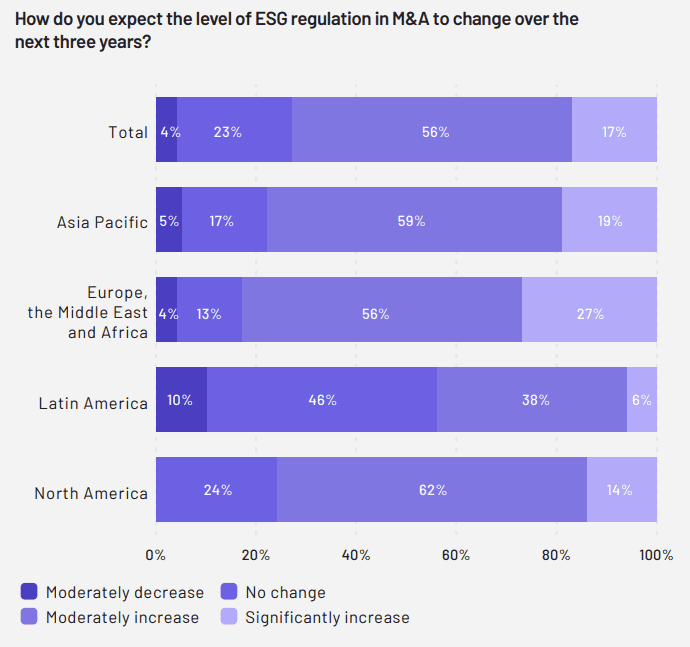

78% of APAC dealmakers expect environmental, social, and corporate governance (ESG) regulations related to M&A to increase over the next three years. 19% expect to see a significant increase.

The heightened awareness of ESG issues within the M&A process has caused dealmakers to be greatly concerned regarding potential risks and liabilities. In some cases, the eagerness to increase adherence to sustainable values may even fuel deals forward to accomplish greater ESG performance.

76% of APAC dealmakers expect to spend more time over the next three years to scrutinize ESG factors during the due diligence phase of transactions. 43% of dealmakers in the APAC region are also focusing on diversity when they look at new M&A targets.

M&A activity in the APAC region has proven itself to be resilient throughout 2022, remaining relatively unaffected by prevailing economic conditions. Optimism for continued dealmaking is strong with 31% of respondents expecting M&A activities to increase significantly within the next twelve months. It appears that there are still opportunities aplenty in this marketplace.

Source: SS&C

Read next: SMBs and enterprises to increase IT security budgets to 14% in the next three years – Kaspersky