The Ethernet switch market maintained its strong growth in Q4 2022, fueled by several trends. The main driving force was the ongoing decrease in component shortages and supply chain disruptions. This development was coupled with the expansion of Ethernet switching capacity among enterprises, service providers, and hyperscalers, highlighting the growing importance of network infrastructure and connectivity in today’s digital-first business landscape.

In Q4 2022, global Ethernet switch revenues surged by 22.0% YoY to reach $10.3 billion, while the full-year 2022 growth was 18.7% to reach $36.5 billion, reports IDC. Meanwhile, the overall worldwide enterprise and service provider router market generated $4.6 billion in revenue in Q4 2022, representing a modest 0.7% YoY increase. For the entire year, router market revenues climbed 3.9% to $16.5 billion.

Ethernet switch market

Both the data center and non-datacenter segments of the Ethernet switch market exhibited strength in Q4, with robust revenue and port shipment growth.

- The non-datacenter/enterprise campus and branch segment saw a 22.6% YoY revenue growth in 4Q22, accompanied by an 18.0% YoY rise in port shipments. For the entire year, non-datacenter Ethernet switch revenues climbed by 15.7%, while port shipments grew by 12.2%.

- The data center portion of the market recorded a 21.2% YoY increase in revenues in 4Q22, coupled with a 17.3% YoY rise in port shipments. For the full year, data center Ethernet switch revenues surged by 22.6% YoY, while port shipments increased by 12.2%.

Higher-speed Ethernet switch market

The higher-speed segments of the Ethernet switch market are experiencing robust growth, buoyed by cloud providers and hyperscalers investing in data center network capacity.

- Market revenues for 200/400 GbE switches surged by over 300% for the entire year in 2022 but remained stagnant with a 0.7% sequential growth from Q3 to Q4 in 2022.

- In Q4 2022, 100GbE revenues increased by 18.7% YoY, while the full-year growth was 22.0%.

- Additionally, 25/50 GbE revenues soared by 30.1% YoY in Q4 2022, and the full-year growth was 29.8%.

Lower-speed Ethernet switch market

Lower-speed switches, commonly used in enterprise campus and branch locations, also exhibited strength.

- In Q4 2022, revenues for 1GbE switches surged by 21.4% YoY, while the full-year growth was 12.6%.

- Meanwhile, 10GbE switches recorded a 1.0% YoY growth in the quarter but were unchanged at 0.4% for the entire year.

- Multi-gigabit Ethernet switches, also known as 2.5/5GbE switches, saw a remarkable 122.1% YoY rise in revenue in Q4 2022, accompanied by a sequential growth of 53.1% from Q3 to Q4 in 2022.

Ethernet switch market across regions

Most regions of the world witnessed growth in the Ethernet switch market.

- In the Asia/Pacific region, excluding Japan and China, the market Went by 20.8% YoY in Q4 2022 and rose 17.5% for the full year. In China, the market declined by 5.0% YoY in the quarter but rose by 9.2% for the full year. Japan’s market fell 6.4% YoY in the quarter and was down 8.6% for the entire year.

- The United States market witnessed a significant rise, growing by 32.2% YoY in Q4 2022 and 26.2% for the full year, while Canada’s market increased 25.6% YoY in the quarter and rose 17.0% for the full year. In Latin America, the market soared by 82.7% in the quarter and increased by 39.6% for the full year.

- In Western Europe, the market grew by 25.3% annually in Q4 2022 and increased by 19.7% for the full year. In the Middle East & Africa region, the market rose by 49.9% in Q4 2022 and rose 19.9% for the full year. However, the Central and Eastern Europe market saw a decline of 1.7% in the quarter and ended the full year off by 2.8% as compared to 2021.

Router market

- The service provider segment comprising both communications service providers (SPs) and cloud SPs, constituted 73.7% of the market’s total revenues. This segment saw a 4.0% decrease in revenues in 4Q22 compared to the previous year, but for the full year, it increased by 1.3%.

- The enterprise segment, which makes up the remaining share of the market, saw a rise of 17.1% in revenues in the quarter and an increase of 12.9% for the full year.

Router market across regions

- In the US, the combined service provider and enterprise router market grew by 18.5% year over year in 4Q22 and 17.0% for the entire year. Meanwhile, in Canada, the router market rose by 12.3% in the quarter and by 1.4% for the full year. The Latin American market rose by 5.2% in 4Q22 and by 16.7% for the entire year.

- In the Asia/Pacific region, excluding Japan and China, the market went up 0.7% in the quarter but declined by 3.9% for the full year. In Japan, the market grew by 5.6% in 4Q22 and by 0.3% for the full year, whereas in China, the market went down by 18.9% in the quarter and 6.7% for the full year.

- Revenues in Western Europe fell by 1.0% in 4Q22 but rose by 5.2% for the full year, whereas the Central and Eastern Europe market decreased by 17.1% in Q4 2022 and 21.2% for the full year. Finally, the Middle East & Africa region grew by 5.2% in the quarter and by 3.7% for the full year.

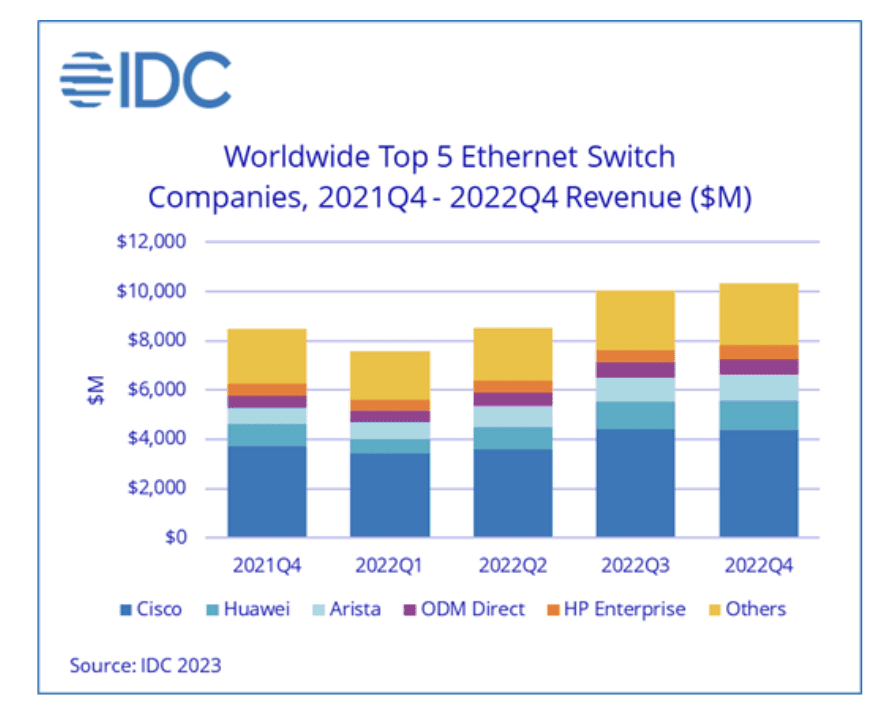

Top 5 Ethernet switch companies

Cisco: In Q4 2022, Cisco witnessed an 18.4% YoY growth in Ethernet switch revenues, and a 13.4% increase for the full year, earning the company a market share of 43.3% at the end of 2022. Meanwhile, the company’s combined service provider and enterprise router revenue grew 10.9% in the quarter and 5.5% for the full year, giving it a market share of 35.1%.

Huawei: Huawei’s Ethernet switch revenue grew by 28.6% in Q4 2022 and increased by 20.0% for the full year, resulting in a market share of 10.3% at the end of 2022. However, its combined SP and enterprise router revenue fell 15.1% YoY in Q4 2022, and declined by 3.4% for the full year, with a market share of 28.4%.

Arista Networks: Arista Networks’ Ethernet switch revenues soared by 63.6% YoY in Q4 2022 and the revenue for the full year rose 55.4%, giving the company a market share of 9.9% by 2022.

H3C: H3C’s Ethernet switch revenue decreased by 10.0% YoY in Q4 2022 but rose by 5.1% for the full year, resulting in a market share of 5.4% in 2022. In the combined service provider and enterprise routing market, the company’s revenues fell 8.6% in the fourth quarter, and remained flat with 0.4% growth for the full year, leading to a market share of 2.2% by the end of 2022.

HPE: HPE’s Ethernet switch revenue increased by 14.0% in Q4 2022 and gained 5.3% for the full year, earning a market share of 5.4% at the end of 2022.

Source: IDC

Read next: Majority of SaaS companies saw high growth in 2022, but with a decline in December