Telecom, Pharmaceuticals, Automotive, and IT Services, for the majority of the past two decades, have been seen as the flag-bearers of the so-called ‘Sunrise Sectors’ in India. It has been sometime since these were the trending themes, albeit much before the Internet made the kind of impact it has made in our lives.

The normalization of ‘Digital’ has presented an opportunity to cash in on yet another theme which can be a key contributor to India’s quest of US$1trillion Digital Economy – Datacenters

Introduction

The zetabytes of data that is generated today (estimated to grow from 33ZB in 2018 to 175ZB by 2025) within the ‘Datasphere’ (1) and the ascendancy of country-specific laws governing storage, data-residency and use, has helped identify a huge business and economic potential in Datacenters; including in India.

In India, the next value addition is coming from India’s start-up ecosystem, enabled by Cloud, AI, Data & Analytics. A lot has been said and written about these trends in recent times, including the foray of India-built platforms (read software products) as a key contributor to this burgeoning global Digital Landscape. However, a key enabler of this Digital Transformation has probably not caught the eye of the investors, tech leaders, or decision-makers, at least not to the extent as some of the other aspects of the Digital Landscape have been.

Datacentres – The India Opportunity

Starting 2018, India has moved up the global internet data usage charts significantly. By all accounts, boasting of the lowest possible telecom tariff in the world has had its effects. Per device data usage has topped ~14.6GB per month, the second highest in the world. This is expected to breach the 40GB mark by 2026, according to Telco equipment major Ericsson. While internet penetration remains at 55%, the sheer number of smartphones on the 4G LTE network makes up for it. The burgeoning volumes of content and data that is generated is also a critical factor in determining the future. Investments in Smart Cities, with millions joining the internet expressway via proliferation of e-commerce, agri-tech, digital transactions including mobile payments, rural banking, evolving healthcare data landscape, etc. all point towards unimaginable volumes of data that needs to be managed and kept safe. Several new initiatives such as the Integrated Healthcare focused Digital Health ID, converging private healthcare data of

Indian citizens, are some of the policy-level triggers that may witness large-scale changes.

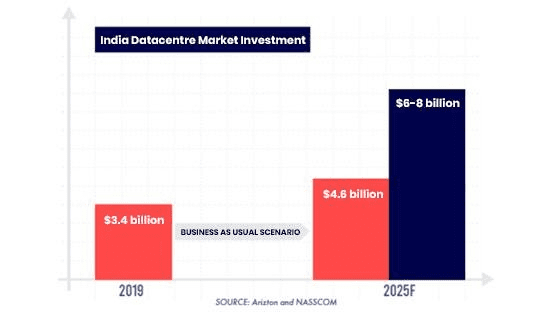

From the perspective of internet infrastructure new sub-sea links (India-ASIA-X-press system), and large available land-mass can trigger a spate of investments in this space. It is expected that investments in the Indian Data Center market is going to clock a high growth rate in the APAC region, one behind China, at 5% CAGR till 2025. This is expected to reach US$4.6bn by 2025, according to an estimate by industry body NASSCOM in its report ‘India – The Next Datacenter Hub‘.

The focus of the Government via policies, datacenter guidelines and research-based suggestions all point towards an emergent landscape involving infrastructure/real-estate players, service providers, hardware & network providers, Government agencies/ministries etc.

Core Market Drivers:

1. Supportive Government Policies: Widely reported in Aug, 2021, the Government of India has planned Rs.12,000cr in sops and incentives to give a fillip to the Data Center/Services providers to set up shop in India. Along with financial incentives to the tune of 3-4% of the total cost, the Government is looking to invest Rs. 3L crore in the next 5 years apart from providing real estate support and consultancy.

2. Legislation Around Data Localization: The Personal Data Protection Bill, 2018, for example, proposes that critical personal data of Indian citizens, particularly ‘Identifiable’ data must be processed in Datacenters which are physically present within the borders. PwC’s commentary “Data localisation may entail greater investments in terms of time, cost and new infrastructure, …..would aid the growth of datacentres and the cloud computing industry in India” is an observation inline with the evolving scenario.

3. G2C Services (Government to Citizen) Boom: In India Government to Citizen (G2C) services spanning Education, Healthcare, Agriculture, Identity, and Payments can play a crucial role in the development of the ecosystem. Each of these programmes involve terabytes of data belonging to the citizens that have to stored, managed and retrieved based on requirements. Also, there is the question of security of identifiable information of citizens. This burgeoning data-lake is a gold-mine of information that can help citizens access government services and will also enable the Government to be inclusive in their rollouts. It is not just corporates, the Government is also a key stakeholder in terms of rolling out policies, governance structures and also as data custodian.

4. Growing Stakeholder Ecosystem: For the Telecom and Real-estate service providers, this is yet another greenfield opportunity to not only add value but also in terms of developing the landscape. Recently, NTT and Tokyo Century have annouced the expansion of their business in India through an SPV to cover the Navi Mumbai area, which is one of the fastest growing regions in India from a Datacenter infrastructure perspective. Similarly Yotta, the Datacenter arm of Hiranandani Group has planned two new Datacenters of 30MW each in NOIDA to be available in 2024. Nxtra (Airtel) and Oracle Cloud Infrastrcuture are also planning new Datacenters in some of the high-growth regions.

5. The Dataverse: Data is also generated by users, particularly through adoption of collaboration tools, content platforms and the like. This part is entirely driven by users of various social platforms, also known as ‘content creators’. Apart from this, India is home to a large number of deep-tech start-ups encompassing edutech, fintechs and healthtechs. The big-techs can avail this opportunity to set-up captive datacenters, particularly players like – Facebook, Google, AWS and Azure.

6. Mobility Solutions: IoT and connected systems are the biggest enablers within the Automotive industry today, apart from the thrust it provides to Mobility solutions powered by Electricity. The competition for Li-Ion batteries, integrations, ICE, Autonomous-driving capabilities and associated infrastructure push will also generate data that can be used across a variety of functions.

7. Upcoming 5G/6G Roll-out: Riding on the significant uptake in data consumption fueled by next-gen telecom solutions, the Telecoms can also be a significant partner within the ecosystem. The Law & IT Ministry has given the green signal for the development of 6G technology with the aim to roll-out by end of 2023 or 2024.

Today, most companies which were on the wings and weren’t sure of taking the plunge into Digital have been forthcoming when it comes to preparing blueprints, taking technology assessments, fit-gap analysis and the like to join the Digital bandwagon. This phenomenon can be seen across industry segments including BFSI, Automotive, Manufacturing (Digital Twins, Industry 4.0 etc.), Healthcare, Education and the Public sector. Digital transactions is the order of the day, omni-channel touch-points, seamless customer experience (CX), e-commerce are all primed towards the Digital First/Cloud-First theme. Add to this Business Transformation goals through Finance, HR, Marketing and a host of other horizontal processes, you have the perfect recipe for a data-boom.

There has been another noteworthy shift in terms of how companies with product depth are surrounding their customers with adjacency – meaning creating a whole ecosystem of Products and Services that can be termed as One-Stop-Shop. The trend is about shifting from their original/orthodox industry classifications to other segments creating value-add for customers as well as new competitors. In India, large conglomerates such as HDFC, Reliance, Tata Sons etc are consciously creating adjacency for their products and services with an aim to consolidate the market. From a customer point of view, more interaction would lead to increased data generation, which has to be managed.

For more details, please download the report:

https://nasscom.in/knowledge-center/publications/india-%E2%80%93-next-datacenter-hub

References:

1. https://indianexpress.com/article/technology/tech-news-technology/6g-technology-launch-likely-by-2023-end-or-2024 says-ashwini-vaishnaw-7638108/

2. https://www.meity.gov.in/writereaddata/files/india_trillion-dollar_digital_opportunity.pdf

3. https://www.trai.gov.in/sites/default/files/201609070926463672475Nasscom_0.pdf